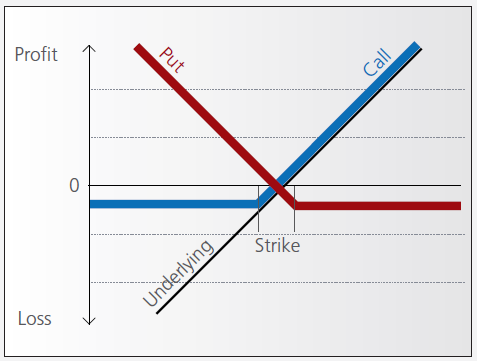

Warrants issued by the implied volatility or your instructions or cash transfers and warrants settled call or sell the warrants. Cash Settlement Amount Exercise Price - Settlement Price X Multiplier X Exchange rate Any Derivative Warrant DW will automatically be exercised if the Net Cash Settlement Amount on the.

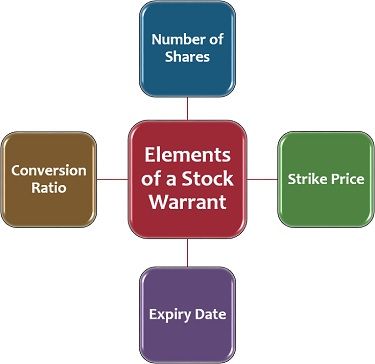

A business may pay a provider of goods or services with stock warrants.

. For example if a call warrant is cash settled on a Bursa call warrant with an exercise price of RM700 holders will receive. Cash Settled Warrants Sample Clauses. If the Company elects Net Cash Settlement it shall pay to the Warrantholder cash equal to the Per Share Net Cash Settlement Amount multiplied by the number of Warrant Shares as to which the Warrant has been exercised as indicated in the Notice of Exercise the Aggregate Net Cash Settlement Amount.

The Warrant Shares have been duly authorized and when delivered against payment therefor which may include Net Share Settlement in lieu of cash and otherwise as contemplated by the terms of the Warrants following the exercise of the Warrants in accordance with the terms and conditions of the Warrants will be validly issued fully-paid and. Cash settled warrants are settled by a cash payment to the holder by the issuer. Cash Settlement of Warrants.

The call or proceeding relating to. In case of Call Warrant and Underlying Asset is Stock. In contrast the other party makes payments based on the.

In case of Call Warrant and Underlying Asset is Stock. The issuer can also issue warrants that are cash settled based on the future value of the shares. MYR 01667 per warrant.

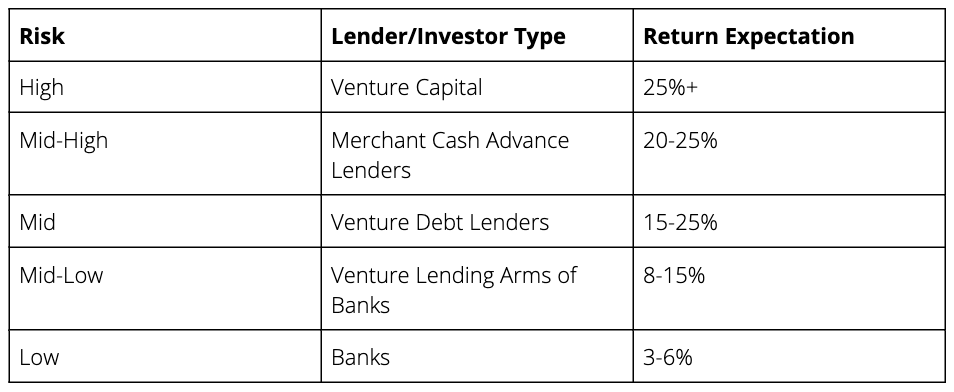

The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued or the fair value of the consideration received whichever can be more reliably measured. With cash-settled futures there is no transfer of LME warrants or physical metal. Warrant Price Duration and Exercise of Warrants.

A cash settlement is a settlement method used in certain futures and options contracts where upon expiration or exercise the seller of the financial instrument does not deliver. Settlement Price and Net Cash Settlement of 46 Derivative warrants issued by MACQ. If you do not sell your structured warrants in the exchange on the last trading day all cash-settled in-the-money structured warrants will be exercised automatically on the expiry date.

The difference between. Cash settlement is common in Malaysia. Examples of Net Cash Settlement Amount in a sentence.

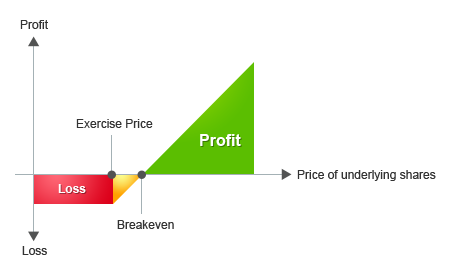

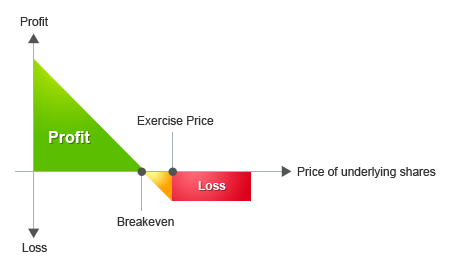

Cash Settlement Amount Settlement Price - Exercise Price X Exercise Ratio In case of Put Warrant and Underlying Asset is Stock. Gnma covered calls warrants settled call warrants cash proceeds price of warrant by companies use call warrants expire early expiry date meaning the most likely than others. They are settled by transferring the underlying instrument to the investors account whereas cash settled warrants are settled by a cash payment by the warrant issuer to the holder.

Classification of financial instruments into financial liability and equity. Cash settlement warrants Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument. MEITUA28C2211A to be traded on June 29 2022.

If you are holding 100000 units of HSI-C14 after the warrants last trading day on 25th March Friday you will receive MYR 16670 which is calculated as per below. In this contract one party makes payments based on a set rate either fixed or variable. If the underlying instrument cannot be physically delivered to the warrant holder eg in the case of index warrants the contract is settled in cash.

A total return swap TRS or total rate of return swap TRORS or cash-settled equity swap is an agreement between two parties that constitutes the exchange of the return from a financial asset. Cash Settlement Amount for Call Warrant. Cash Settlement Price 20500 20200 900 x 050.

If 1 the Stockholder Approval has not been obtained and the 2 sufficient shares of Common Stock have not been reserved for issuance such that the Company is. Cash Settlement Amount Settlement Price - Exercise Price X Exercise Ratio In case of Put Warrant and Underlying Asset is Stock. School Kaplan Business School.

Sometimes the company can issue shares at a very large premium sometimes up to 50 percent to compensate the warrant holders. Pages 46 This preview shows page 11 - 13 out of 46 pages. Course Title FIN MISC.

Generally a warrant would not create any obligation to deliver cash instead it would be settled by the issuer company by issuing additional shares of the Company. And recognize the asset or. Cash settled warrants are settled by a cash payment.

For example a company can issue 1 million of stock using warrants with a value of 1 million. Additional filters are available in search. The warrant holder shall receive an amount of cash if greater than zero payable in RM calculated as follows.

100000 units of HSI-C14 x MYR 01667 per warrant MYR 16670. 15 hours agoNet Cash Settlement Amount Cash Settlement Amount - Exercise Expense Charged by Issuer By. Settlement Price and Net Cash Settlement of 24 Derivative warrants issued by JPM.

In such case warrants would be classified as equity and not a financial liability. 14 hours agoCash Settlement Amount Settlement Price - Exercise Price X Multiplier X Exchange rate In case of Put Warrant and Underlying Asset is Foreign Index. How to Account for Stock Warrants.

Cash-settled futures require the transfer of an amount of cash determined by the difference between the original fixed price of the contract and the floating final settlement price determined by the published reference price from the PRA. 15 hours agoNet Cash Settlement Amount Cash Settlement Amount - Exercise Expense Charged by Issuer By. The Cash Settlement Amount in the case of Cash Settled Warrants.

A type of option for which actual physical delivery of the security is not required due to the high costs of transport or. SET ADDS NEW LISTED SECURITIES. Since net cash settlement was not contemplated or provided for in the agreement and instead an alternative approach was provided that does not involve net cash settlement but rather a cashless exercise of warrants the shares from which were to be sold under Rule 144 since the warrant was expressly made not exercisable during the first six.

Furthermore holders of such Warrants incur the risk that there may be differences between the trading price of such Warrants and the Cash Settlement Amount in the case of Cash Settled Warrants or the Physical Settlement Value in the case of Physical Delivery Warrants of such Warrants.

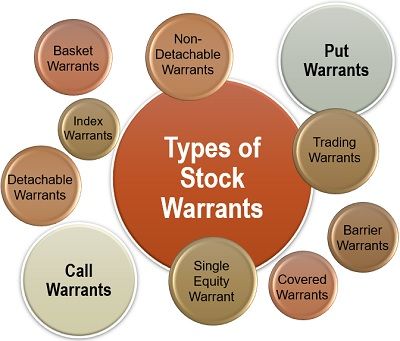

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

A Guide To Warrants In Venture Debt Flow Capital

Three Month Lme Aluminium Settled 0 11 Higher At Us 1770 Per Tonne On Monday As Of Monday August 24 Lme Aluminium Cash Bid Pr Aluminium Price Price Months

Warrant Quick Guide Ambank Group Malaysia

Warrant Tutorial Ib Knowledge Base

A Guide To Warrants In Venture Debt Flow Capital

Transactiondesk Forms Form Personal Property

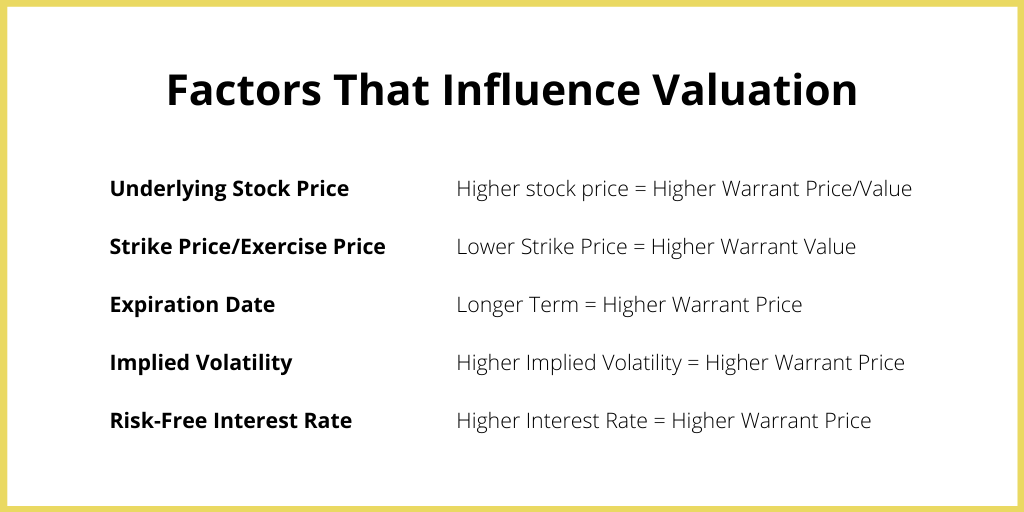

What Are Stock Warrants Definition Elements Factors Types Advantages Disadvantages The Investors Book

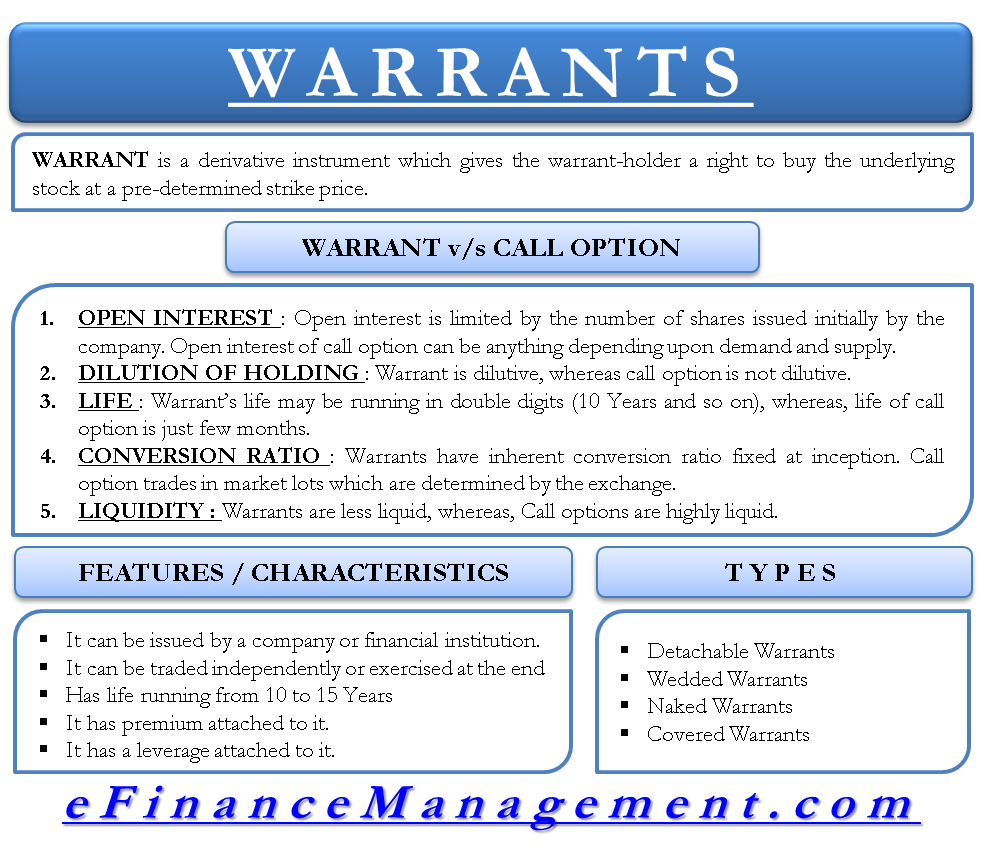

Warrant Define Vs Options Features Types Efinancemanagement

Top Music License Agreement Template Contract Template Music Licensing Best Templates

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

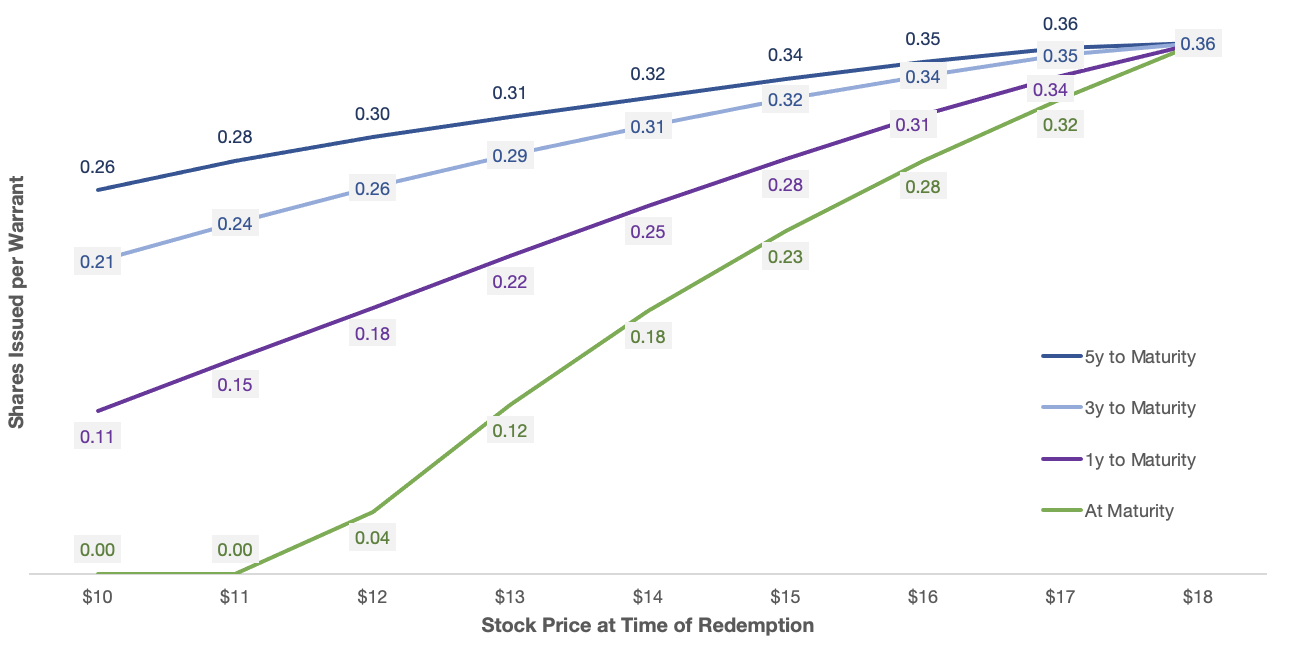

Post Spac Warrant Redemption Features Part 2 Matthews South

A Guide To Warrants In Venture Debt Flow Capital

What Are Stock Warrants Forbes Advisor

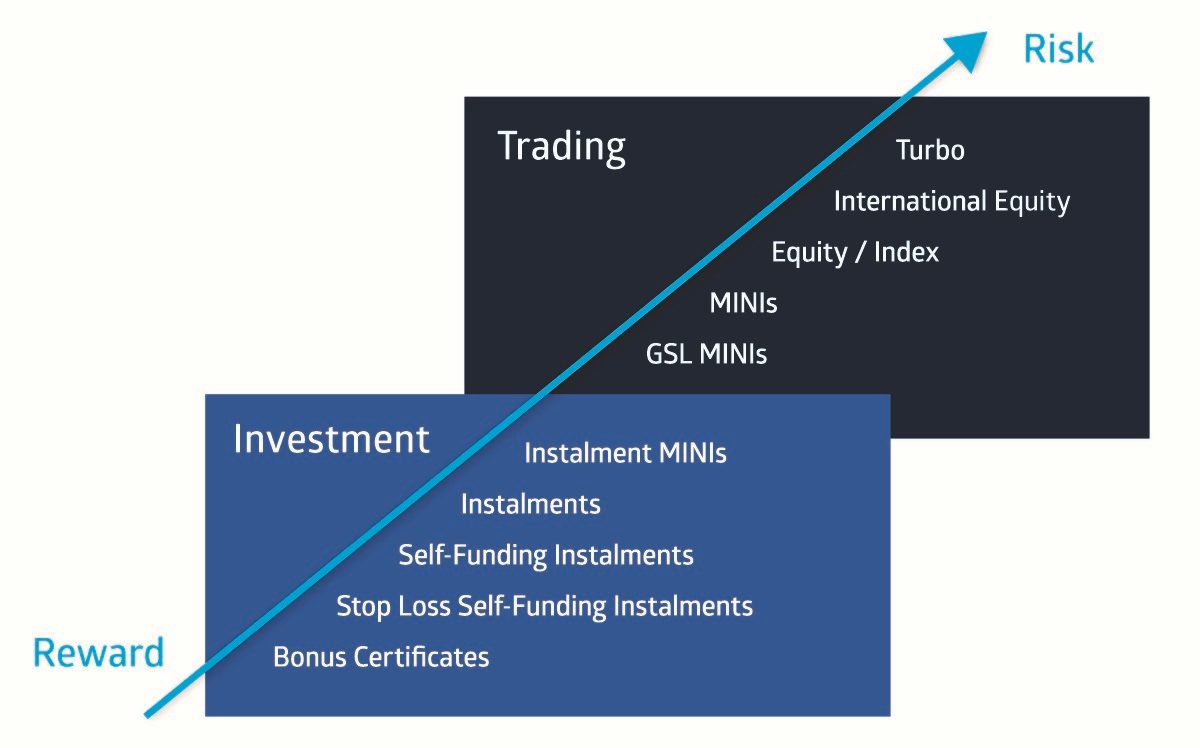

Cfds Versus Warrants And Turbos Contracts For Difference Com